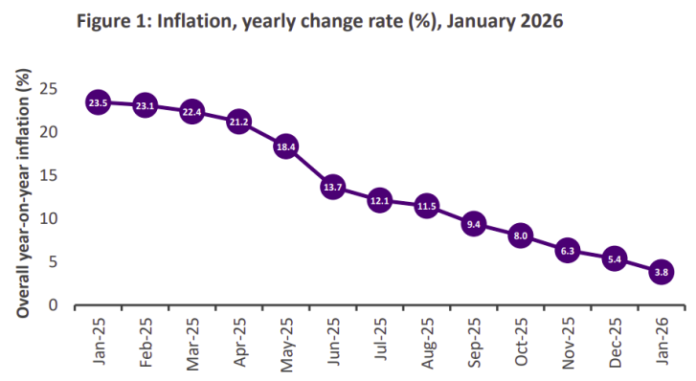

Ghana’s headline inflation rate dropped significantly to 3.8 percent in January 2026—the lowest level since the rebasing of the Consumer Price Index (CPI) in 2021 and marking the thirteenth straight month of decline, according to the Ghana Statistical Service (GSS). Presenting the latest data on February 4, 2025, Government Statistician Dr. Alhassan Iddrisu revealed that the CPI climbed from 252.6 in January 2025 to 262.3 in January 2026. This translates into a year-on-year inflation rate of 3.8 percent, representing a sharp 19.7 percentage-point fall from the 23.5 percent recorded a year earlier. On a month-to-month basis, inflation eased further from 5.4 percent in December 2025, reflecting a 1.6 percentage-point decline

Food and non-food inflation converge

Food and non-food inflation both eased to 3.9 percent in January, down from 4.9 percent and 5.8 percent respectively in December 2025. Month-on-month figures, however, showed a modest 1.1 percent rise in food prices, contrasted by a 0.4 percent decline in non-food prices. A closer look at the CPI basket revealed sharp divergences in price trends: while garden eggs and fresh tomatoes dropped significantly by 58.7 percent and 42.5 percent, key household essentials such as charcoal and green plantain surged by 53.7 percent and 67.9 percent year-on-year.

Regional disparities

Despite the national decline, inflation varied widely across regions. The North East Region recorded the highest rate at 11.2 per cent, while the Savannah Region experienced deflation at -2.6 per cent. The GSS attributed these gaps to differences in “local supply, transport costs, and market access.” Greater Accra and Ashanti regions, which together account for nearly half of the national consumption basket, recorded modest inflation rates of 3.0 per cent and 4.0 per cent, respectively.

Imported vs. locally produced goods

Inflation for locally produced items fell to 4.5 per cent, while that for imported items eased to 2.0 per cent. This indicates that domestic cost pressures are now a more significant driver of price changes than imported inflation, a shift from previous trends.

Services and goods inflation eases

Inflation for goods slowed to 3.6 per cent from 5.8 per cent in December, while services inflation moderated to 4.0 per cent from 4.5 per cent. Month-on-month, service prices rose by 0.3 per cent, while goods prices remained stable.

Policy implications and outlook

Economists say the continued disinflation could provide room for monetary policy easing and reinforce business and consumer confidence. The GSS, in its release, recommended that the government “sustain fiscal discipline” and “invest in storage, irrigation, transport, and market access to reduce regional disparities.” For households, the GSS advised that “this is a good time to plan budgets with greater confidence, prioritise essentials, avoid non-essential spending, and save where possible.”

Source: Kweku Zurek